Rock Health 2022 Year-End Report

Lessons at the end of a funding cycle

$15.3B was raised in 2022—far lower than 2021's $29.3B and barely surpassing 2020’s $14.7B—signaling the tail end of a macro funding cycle that started in 2019 and peaked with the COVID-19-era investment boom.

#StartupHealth #DigitalHealth

StartUp Health 2022 Year-End Report

The Great Recalibration

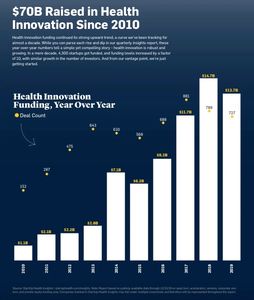

2022 health innovation funding dropped by 50% YoY, yet we’re as optimistic as ever. In our year-end StartUp Health Insights report, we explore the factors that could make 2023 a break-out year for early-stage health startups (in spite of gloomy macro-ecomonic trends) and explain why a health moonshot mindset should always involve a long view of the market.

#StartupHealth #DigitalHealth

Rock Health 2021 Report

Seismic shifts beneath the surface

2021 saw $29.1B raised by U.S. digital health companies across 729 deals. + 2021’s 272 M&A deals almost doubled 2020’s 146, and there were a record 23 public exits, nearly triple 2020’s eight.

However, beneath the chart-topping numbers are signals of something deeper. 2021’s funding frenzy was, at points, both the cause and effect of bigger shifts within healthcare.

#StartupHealth #DigitalHealth

StartUp Health 2021 Year-End Report

$44B raised globally in health innovation, doubling year over year. Thanks to a wave of mega deals in the United States, England, India, and China, health innovation funding has reached heights that would have seemed impossible just a year or two ago. Plus, acquisitions are up 50%, and more than 20 companies went public.

#StartupHealth #DigitalHealth

Rock Health 2020 Market Insight Report

Chasing a New Equilibrium

2020’s stress test to our healthcare system created what felt like a fast forward button for digital health, with unprecedented growth in funding, adoption, policymaking, and national attention.

Venture capital dollars flowed to US digital health companies at a new all-time high, with over $14B invested across 440 deals. 2020 also represented a thematic shift in liquidity for digital health venture investors, with upswings in both IPO and M&A activity.

While questions remain about a new equilibrium for the digital health market, this post explores four factors underpinning what we see as a durable investment sector: sustained commitment from investors, new consumer behavior change, rising enterprise buyer appetite, and a breakout exit market.

#Rockhealth #DigitalHealth

Startup Health 2020 Funding Report

2020 Record Breaking Year For Health Innovation Funding - sets the stage For new era of moonshot progress.

The books are closed on what has been a historic year for health innovation funding. Continuing the upward trend that began halfway through the year, we’re finishing 2020 with a colossal $21.6B raised globally across every sector of health innovation. That makes 2020 the most-funded year in history for health tech, by a mile. 2020 bested 2019 by 55% and 2018 by 46%.

#StartupHealth #DigitalHealth

Rock Health Q3 2020 Funding Report

Q3 2020: Here’s one more way 2020 is unlike any other year: it is already the largest funding year ever for digital health. The $4.0B invested in US-based digital health startups through Q3 brings the year’s running total to $9.4B, far exceeding what used to be the largest annual sum of $8.2B in 2018. At least $2.4B has been invested each quarter this year—consistently above the quarterly average of $2.1B across 2018-2019. And even more so than in recent years, large deals are driving the top-line numbers. The average deal size in 2020 is $30.2M, 1.5 times greater than the $19.7M average in 2019.

#Rockhealth #DigitalHealth

Startup Health 2019 Funding Report

2019 continued the strong upward trend in health innovation funding that we’ve been tracking for most of a decade. With $13.7B in total funding across 727 deals, 2019 was the second most-funded year ever, and we see the trend continuing.

We’ve called 2019 “The Year of the Patient” because of the dramatic funding of “patient empowerment” tools, but that wasn’t all that caught our attention at the end of the decade.

#StartupHealth #DigitalHealth

Rock Health 2019 Funding Report

In 2019, digital health celebrated six IPOs as venture investment edged off record highs.

Across the last decade, digital health has grown from a blip on the radar of investors to a robust sector receiving nearly one in ten venture dollars invested in the United States. In 2019, 359 US digital health startups raised $7.4B from 627 investors. Though six digital health companies entered the public markets in 2019, exits were a somewhat mixed bag, with M&A below trend at 112 deals across 2019.

#Rockhealth #DigitalHealth

Startup Health 2018 Funding Report

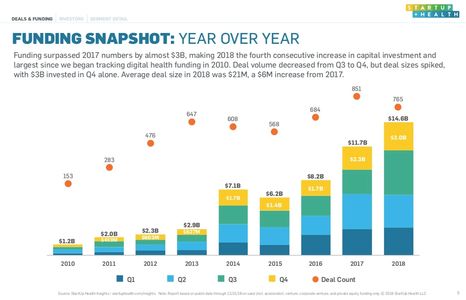

Startup Health 2018 Funding Report:

$14.6B of venture funding pumped through digital health in 2018, making it the most-funded year since we started tracking the market. But while growth has become the norm, trends suggest that this is just the first inning of a very long game.

#StartupHealth #DigitalHealth

Why invest in Health AI?

According to Accenture, the health AI market is expected to grow more than 10x in the next five years. Growth is already accelerating, as the number of healthcare-focused AI deals went up from less than 20 in 2012, to nearly 70 by mid-2016.

#Accenture #Healthai

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.